MESSAGE FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS

In 2019, Fibabanka continued its support for the real sector, while focusing on asset quality, sustainable profitability and efficiency. With this approach, we concluded the year successfully in accordance with our projections and targets.

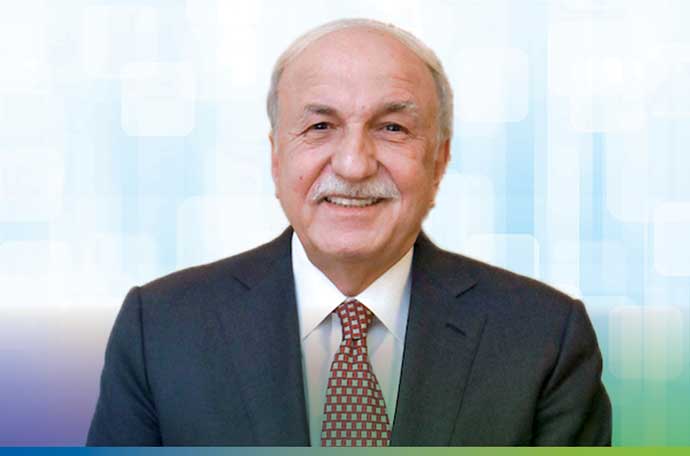

HÜSNÜ M. ÖZYEĞİN

CHAIRMAN OF THE BOARD OF DIRECTORS

More information

MESSAGE FROM THE GENERAL MANAGER

The professional management approach of our main shareholder, Fiba Group, was instrumental in the sustainable success we achieved in 2019. We completed the fiscal year 2019 successfully by maintaining our focus on strong capital, excellent customer experience and efficiency.